The Ultimate Guide To Pvm Accounting

The Ultimate Guide To Pvm Accounting

Blog Article

Things about Pvm Accounting

Table of Contents8 Easy Facts About Pvm Accounting DescribedThe 10-Second Trick For Pvm AccountingPvm Accounting for BeginnersPvm Accounting Can Be Fun For AnyoneSome Known Incorrect Statements About Pvm Accounting Pvm Accounting Can Be Fun For AnyonePvm Accounting for Dummies

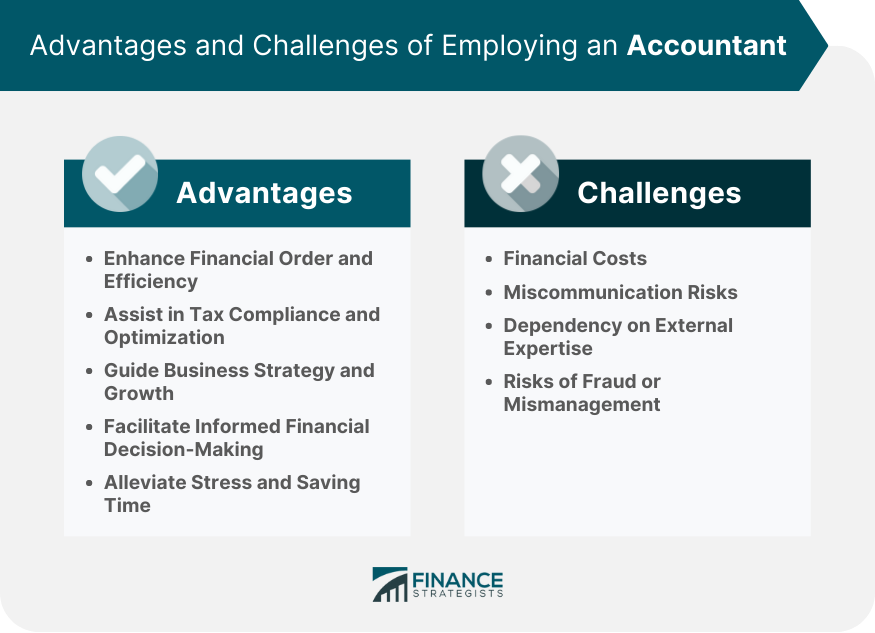

When you have a handful of choices for a small organization accountant, bring them in for quick interviews. https://forums.hostsearch.com/member.php?261228-pvmaccount1ng&tab=aboutme&simple=1. Entrepreneur have numerous other duties tailored in the direction of development and growth and do not have the moment to handle their funds. If you have a little service, you are most likely to deal with public or private accountants, that can be employed for an internal service or contracted out from an accountancy firmAs you can see, accountants can assist you out during every phase of your company's growth. That doesn't suggest you have to work with one, but the best accounting professional ought to make life easier for you, so you can focus on what you enjoy doing. A CPA can help in tax obligations while also giving clients with non-tax services such as bookkeeping and economic encouraging.

Our Pvm Accounting Ideas

Working with an accounting professional lowers the likelihood of declaring imprecise documentation, it does not totally eliminate the opportunity of human error impacting the tax return. A personal accounting professional can aid you plan your retired life and likewise withdrawl.

An accountant is an expert that manages the financial wellness of your business, day in and day out. Every small organization proprietor need to think about hiring an accounting professional prior to they really need one.

The smart Trick of Pvm Accounting That Nobody is Discussing

They'll likewise likely come with a valuable expert network, along with wisdom from the successes and failings of businesses like your own. Hiring a Cpa who understands https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ fixed asset bookkeeping can appropriately value your property while remaining on top of variables that influence the numbers as time takes place.

Your accounting professional will certainly additionally provide you a sense of essential start-up costs and investments and can reveal you exactly how to keep functioning also in periods of reduced or adverse money flow. - https://pagespeed.web.dev/analysis/https-www-victoriamarcelleaccountant-com/7eyanprcv9?form_factor=mobile

Little Known Questions About Pvm Accounting.

Filing tax obligations and taking care of financial resources can be particularly challenging for small service proprietors, as it requires knowledge of tax obligation codes and financial guidelines. A Qualified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) can offer invaluable support to small service owners and aid them Learn More browse the complex world of financing.

: When it pertains to accounting, bookkeeping, and economic preparation, a certified public accountant has the expertise and experience to assist you make notified choices. This competence can conserve small company owners both money and time, as they can depend on the CPA's knowledge to ensure they are making the best financial choices for their company.

Excitement About Pvm Accounting

Certified public accountants are trained to remain updated with tax obligation regulations and can prepare exact and prompt income tax return. This can conserve small company proprietors from migraines down the line and guarantee they do not deal with any charges or fines.: A CPA can additionally help local business proprietors with monetary planning, which entails budgeting and forecasting for future development.

: A CPA can additionally supply useful insight and analysis for tiny service owners. They can assist recognize areas where business is prospering and areas that need improvement. Armed with this details, local business proprietors can make modifications to their procedures to maximize their profits.: Lastly, hiring a CPA can offer small company owners with assurance.

Not known Facts About Pvm Accounting

The government will not have the funds to provide the services we all rely upon without our tax obligations. For this reason, everybody is urged to prepare their taxes before the due day to guarantee they prevent fines.

The size of your income tax return depends on lots of factors, including your earnings, deductions, and credit histories. Consequently, employing an accountant is recommended since they can see whatever to ensure you get the maximum amount of money. Despite this, several people refuse to do so because they think it's nothing greater than an unneeded expenditure.

All about Pvm Accounting

When you employ an accountant, they can aid you stay clear of these errors and ensure you obtain the most refund from your tax obligation return. They have the expertise and know-how to know what you're qualified for and how to get one of the most refund - construction accounting. Tax season is typically a stressful time for any kind of taxpayer, and for a great reason

Report this page